all about investing in cryptocurrency

All about investing in cryptocurrency

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States sizzling hot deluxe. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

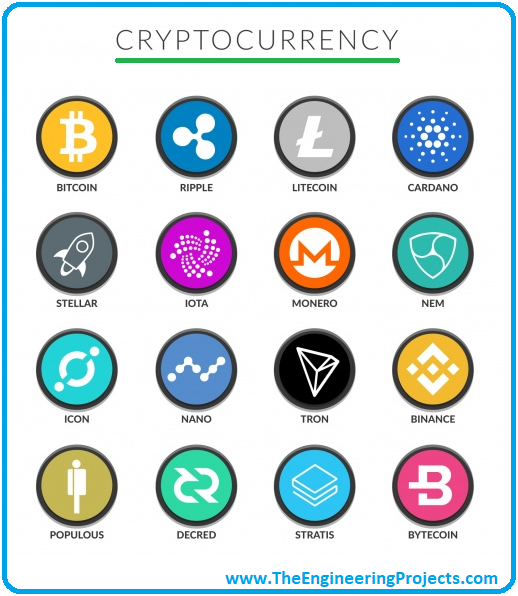

In our capitalist world driven by economy and technology, it should come as no surprise that cryptocurrency has emerged as an enticing playground for investors. However, those who want to participate in this market have to go through a steep learning curve. As a result, many beginners still wonder how to invest in cryptocurrency.

All about cryptocurrency for beginners

Emotional behavior can significantly affect the market, as illustrated in the classic chart “Psychology of a market cycle,” which can provide a more detailed idea of sentiments than the bull/bear concept.

Consolidation occurs when a price trades sideways or within a range. Typically, consolidation phases are easier to spot on higher time frames (daily or weekly charts) and occur when an asset is cooling off after an upward or downward trend. Consolidation also appears ahead of trend reversals or when demand is low.

Mintos is a member of the national investor compensation scheme established under EU Directive 97/9/EC. The scheme protects investors by providing compensation if Mintos fails to return financial instruments or cash to investors. The maximum compensation an investor can claim under the scheme is 90% of their net loss, up to a maximum of €20 000.

The first step to securing your crypto is setting up strong, unique passwords for your accounts on exchanges and wallets. Weak passwords make it easier for hackers to gain access. Additionally, always enable two-factor authentication (2FA) for an extra layer of protection. This means even if someone gets hold of your password, they’ll still need a second code to log in.

All about cryptocurrency trading

Trading CFDs allows you to benefit even when the market price is falling. In that instance, if you believe the price of Bitcoin will fall, you might enter a short (sell) position. If the market price did go down, you would make a profit. But in this situation, you would lose money if the market price rose.

Personal injury settlements can be a lifeline for victims who are seeking compensation for medical bills, lost wages, pain and suffering, funeral expenses, or other damages. However, the process is sadly not always a swift…

Reading through various best crypto exchange reviews online, you’re bound to notice that one of the things that most of these exchanges have in common is that they are very simple to use. While some are more straightforward and beginner-friendly than others, you shouldn’t encounter any difficulties with either of the top-rated exchanges. That said, many users believe that KuCoin is one of the simpler exchanges on the current market.

When it comes to crypto portfolio management, you want to know how much of a particular asset you hold and where it is stored. You also want to know how much you are gaining or losing from a particular trade or investment.

Opening a long position, or buying, means you’re hoping the currency will increase in value. Your goal in this position is to hold the currency long-term while waiting for the currency to jump in value. Short positions, or sells, are the opposite. When you create a short position, you’re expecting the currency’s value to decrease, trading against the crypto market. You earn profits from this trading plan if the currency is less valuable when you close your position than when you opened. If not, you lose money and owe the broker the difference.

In 2023, the cryptocurrency market capitalization surpassed $1 trillion, underscoring its growing importance in the global economy. Platforms like Binance, Coinbase, and decentralized exchanges such as Uniswap enable users to participate in this fast-paced market. This article provides an in-depth overview of crypto trading, exploring its types, strategies, benefits, and challenges, supported by real-world examples and actionable insights.